As such, investments in Bullion involve a degree of risk, which may make them unsuitable for certain persons. Bullion markets can be volatile and the value of Bullion may fluctuate dependent on the market value of precious metals. Please note that certain products, storage and delivery services will be dependent on the type of account you hold. View Live Silver Price View Live Platinum PriceĪll information contained on or available through this website is for general information purposes only and does not constitute investment advice. You can also use the live gold price to calculate the value of your current gold investment portfolio or the value of any gold bullion products you are interested in investing in. If you are looking to invest in gold bullion, one of the most important factors is the gold price and using the information displayed on the chart, you are able to calculate the live price of gold, but also look at historical prices to gain a better understanding of how the gold price varies over time. The gold prices shown on the chart are displayed per troy ounce and are automatically updated every 30 seconds. Our live gold price charts can be used to calculate the value of your investments such as the current gold Sovereign price or the price of a gold bar. As well as the live gold price, you can choose the gold price today or view the gold price history, showing the historic gold value and visualise it over time.

Historic gold pricing update#

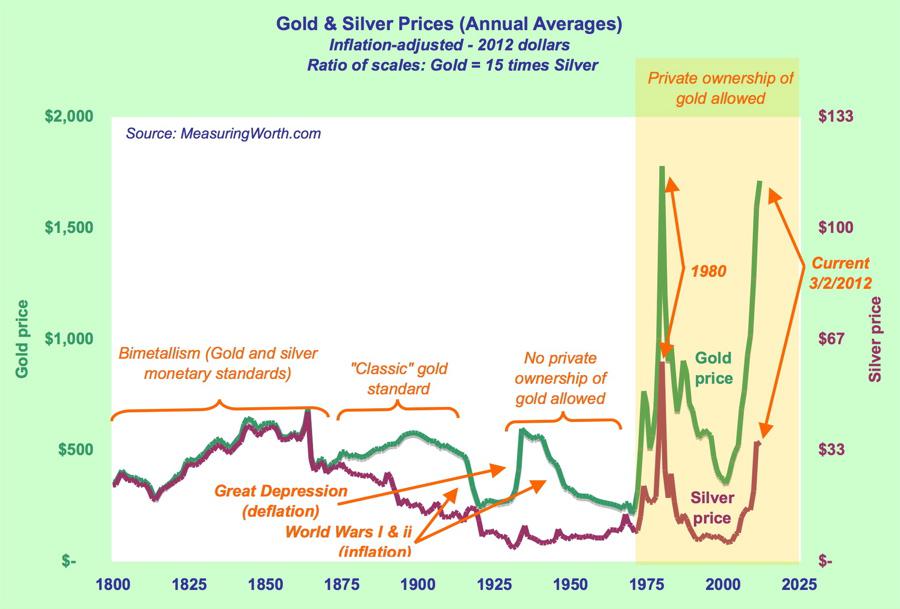

If you adjust the time range, the live gold price chart will update to show the live gold price as well as historical gold prices – depending on the option chosen. government fixed the ratio at 15:1 with the Coinage Act of 1792.Our live gold price charts from The Royal Mint offer you a chance to view the UK gold price in pounds, as well as the price of gold in other currencies including dollar and euro. The Roman Empire officially set the ratio at 12:1 and The U.S.

For hundreds of years the ratio was often set by governments for purposes of monetary stability and was fairly steady. Therefore, shifts in industrial demand can impact the price of silver and, subsequently, the gold-to-silver ratio. Furthermore, Silver has various industrial applications, including in electronics, solar panels, and medical equipment. However, gold has traditionally been favored as a store of value and a hedge against inflation, leading to its higher demand and higher price relative to silver.

Both gold and silver are considered precious metals and are often sought after as safe-haven investments during times of economic uncertainty. The gold-to-silver ratio is influenced by several factors. Conversely, a lower ratio indicates that silver is relatively more expensive compared to gold, suggesting a potential opportunity for gold to outperform silver. A higher gold-to-silver ratio suggests that gold is relatively more expensive compared to silver, indicating a potential opportunity for silver to outperform gold in terms of price appreciation. Historically, the ratio has varied significantly over time, with different ranges considered favorable for either gold or silver investments. It can provide insights into market trends and potential investment opportunities. The gold-to-silver ratio is primarily used as a tool by investors and traders to evaluate the relative value between gold and silver.

The resulting ratio indicates how many ounces of silver are needed to purchase one ounce of gold. It is calculated by dividing the current market price of gold per ounce by the current market price of silver per ounce. The gold-to-silver ratio is a financial metric that compares the price of gold to the price of silver.

0 kommentar(er)

0 kommentar(er)